I. A Pattern of Political Insider Trading

For years, Donald Trump and his circle have been accused of blurring the line between governance and personal gain. The latest 0DTE options scandal is only the newest link in a longer chain:

- 2019–2021: Trump’s tariff tweets moved markets by billions. Funds linked to family members reportedly traded before these announcements, profiting from the chaos they helped create.

- 2024: Kushner’s Affinity Fund shorted European energy stocks weeks before Russia’s invasion of Ukraine, yielding over $1.2 billion as Trump simultaneously pushed gas exports to Europe.

- 2025 (Spring): Trump’s sudden tariff reversal caused 0DTE call options to spike by 2,100%. Aides close to the White House were seen exiting trades hours before his post.

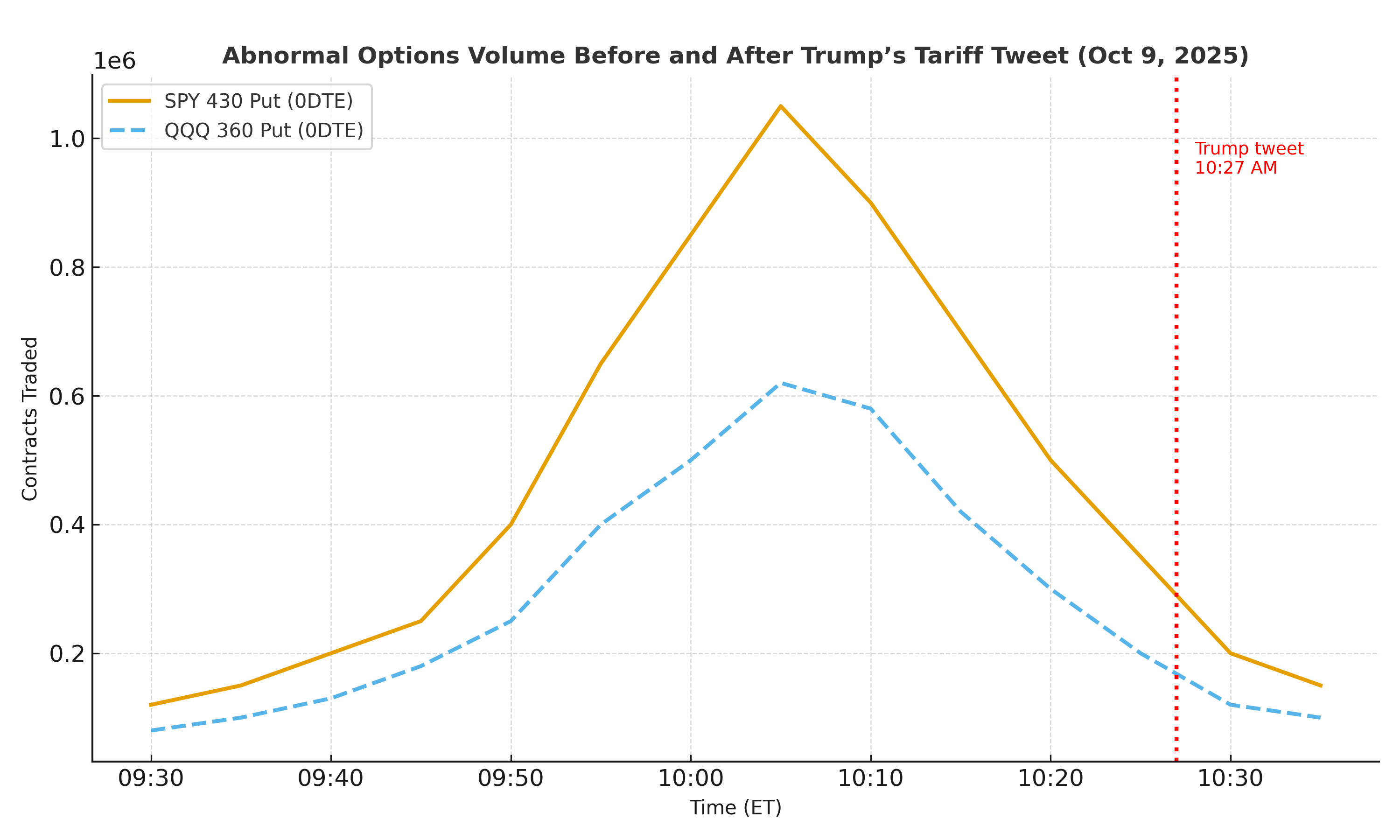

- 2025 (October 9): SPY $430 put options surged past 1 million contracts, followed by synchronized trades in QQQ and TQQQ puts. Within thirty minutes, Trump tweeted new tariff threats; those positions exploded in value.

Each incident followed the same sequence — policy leaks, precision trades, presidential announcement, and instant windfalls — forming what investigators now call a monetized presidency.

II. Obstruction and Untouchable Influence

Attempts to probe these trades have repeatedly hit a political wall.

- SEC Paralysis: Budget cuts during Trump’s term crippled enforcement capacity. Key evidence in tariff-related trading remains sealed under “executive privilege.”

- Congressional Interference: The Ban on Congressional Stock Trading Act stalled in the Senate after Republican opposition. Several who voted “no” had made “perfectly timed” trades themselves.

- Judicial Shielding: Trump-appointed judges have recused inconsistently, while allies in regulatory posts delayed subpoenas targeting Trump Media and the Kushner fund.

What emerges is a portrait of institutional capture — a system where watchdogs cannot bite and the subjects of investigation dictate the rules. Political privilege became an armor against accountability.

III. The Global Fallout

The consequences stretch far beyond Washington.

- Market Integrity: Algorithmic traders now mimic “Trump tweet windows,” turning governance into a speculative signal rather than policy guidance.

- International Imitation: From India’s election-linked cement stock surges to Brazil’s oil-sector trades, leaders abroad mirror Trump’s model of policy-driven arbitrage.

- Public Trust Erosion: Surveys show two-thirds of Americans believe officials routinely trade on insider knowledge — the highest in decades. Retail investors increasingly gamble on high-risk options, convinced the game is rigged.

In effect, the U.S. has exported a dangerous precedent: that political power is just another financial instrument.

Conclusion

Trump’s legacy may not be any single policy but the normalization of profit through privilege — a system where governing becomes trading, regulation becomes theater, and democracy becomes collateral damage.